UK Private REITs: Two Years On

In April 2022, the UK implemented a new “private” real estate investment trust (‘REIT’) regime, which allowed fund managers to take advantage of the various benefits of REITs without having to undertake the more onerous listing requirement imposed since the beginning of the REIT regime in 2007. According to HMRC, there have been 29 private REITs set up since the regime was amended amended[1]and we expect to see the new regime continue to prove popular with fund managers as an alternative to using offshore structuring options.

Contributors

What is a private REIT?

A REIT is a company limited by shares that invests in real estate, in order to primarily undertake property rental business. REITs are exempt from UK corporation tax on both income profits and capital gains, with tax being levied at shareholder level, meaning the tax impact on investors is similar to making a direct investment in the underlying real estate. This is particularly beneficial to tax exempt investors, such as sovereign investors or UK pension funds, who can claim exemptions on property profits received from a UK REIT.

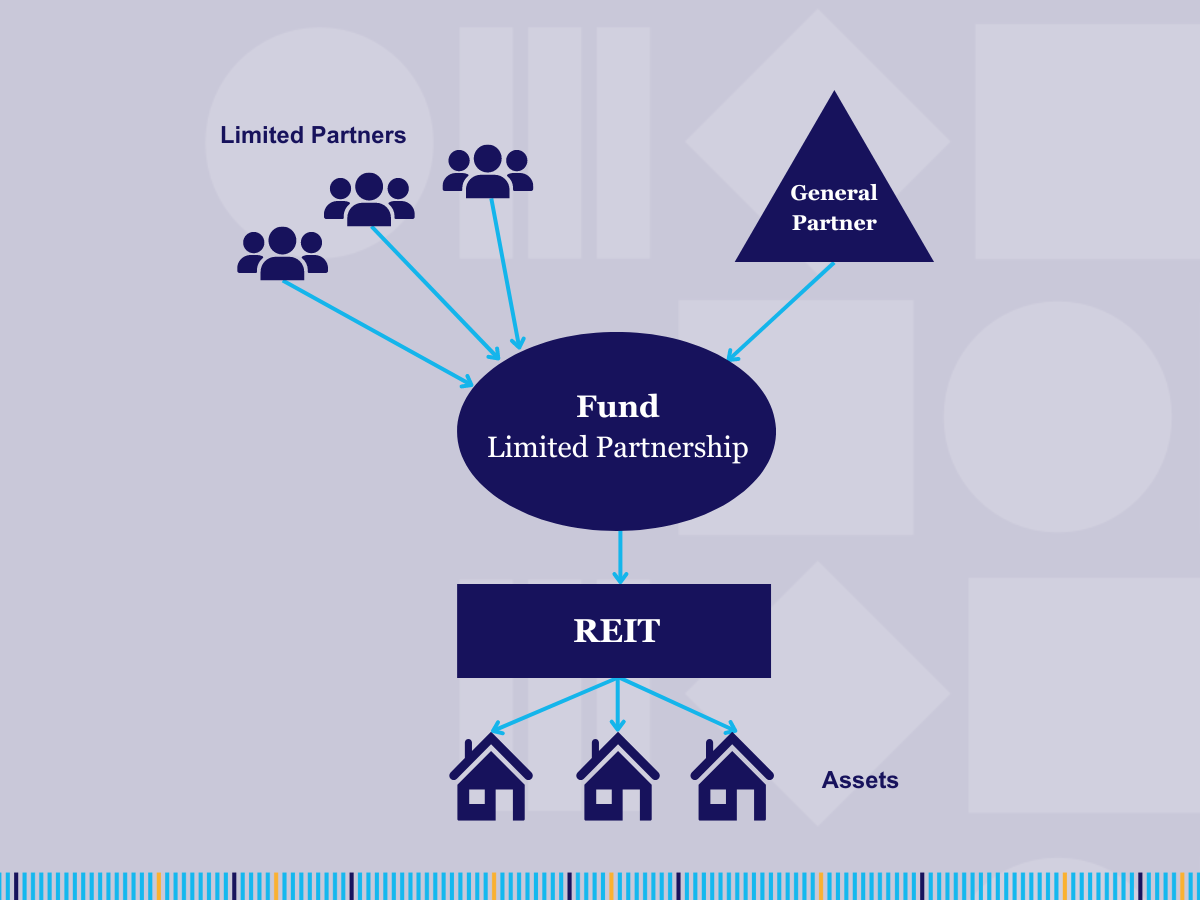

How is a private REIT typically used in a fund structure?

Traditionally, REITs were required to be admitted to trading on a recognised stock exchange, but the 2022 amendments have removed this requirement where at least 70% of the REIT’s ordinary share capital is held by institutional investors. Importantly, other commonly used fund structures (such as authorised unit trusts, or English limited partnerships) that meet a genuine diversity of ownership (‘GDO’) test are themselves considered an institutional investor for the purposes of the 70% test. Furthermore, real estate consultant John Forbes, who was consulted by HMRC on the GDO amendments, said that the rules on this have recently been made even more flexible, allowing ownership by parallel fund vehicles too. Using fund vehicles that meet the GDO test provides an attractive option for fund structuring, and in our experience a number of fund managers are exploring using a partnership structure to admit investors, with a private REIT held directly beneath.

This type of structuring has been commonly used elsewhere, for example in the US, for many years now, so is well understood by global institutional investors.

What are the requirements to hold REIT status?

To maintain private REIT status, managers should be aware of several conditions that must be met for a company to qualify for and continue to hold REIT status, including but not limited to;

- Property Income Distribution (‘PID’): a REIT is required to distribute no less than 90% of its property rental income as a dividend. This income is not taxable at the REIT level but is subject to withholding tax on distribution. Any other profits (e.g. interest receipts or property trading profits) are subject to UK corporation tax. Generally, an experienced fund administrator will work closely with a specialist tax advisor to ensure compliance with the PID requirements.

- Close company test: Companies are considered “close” if controlled by five or fewer participants This is not permitted for REITs. However, the new regime allows REITs to be close for the first three years and can be close if held by an institutional investor.

- Property business: a REIT must hold at least three properties, with no single property representing more than 40% of the value of the REIT. The exception to this rule is where the REIT owns at least one commercial property valued at £20 million or more.

Operational considerations

The PID calculation is, in our opinion, one of the most important elements of running a private REIT. Failure to distribute enough of property income can result in a company potentially losing REIT status, and instead being subject to 25% UK corporation tax. Using an experienced fund administrator in conjunction with a specialist tax advisor minimises this risk.

Additionally, private REITs are also required to submit a quarterly CT61 return for each period in which a PID is paid, and a reconciliation for each accounting period of how distributions made in that period have been attributed. Again, working with a fund administrator that has experience in the operation of these structures is important here.

Finally, there is a “Holder of Excessive Rights” charge levied on any shareholder which is beneficially entitled to 10% or more of dividends or voting rights of the REIT, meaning a tax charge will be imposed on any distributions made to such a shareholder. The new regime relaxes this rule for shareholders who are entitled to gross payment of distributions, such as UK corporates and pension funds, allowing them to avoid having to fragment their shareholdings by use of multiple SPVs.

What next?

We expect to see a continued growth in the use of private REITs for holding income producing real estate in the UK, particularly as so many public REITs continue to trade at deep discounts to NAV. The ability to use a private REIT within a wider fund structure makes for an attractive option to fund managers and makes the UK increasingly attractive as a fund domicile. A private REIT may also be a good stepping stone to a listed REIT later. A pool of assets can be built up when the REIT is private with the REIT then being listed via an IPO at a more propitious point in the market.

Operating such structures comes with complexity, and we would urge anybody considering the use of a private REIT to speak to us about the operational aspects of running such a structure.